GSESS8CG2 | GA's Legislative Branch

Analyze the role of the legislative branch in Georgia.

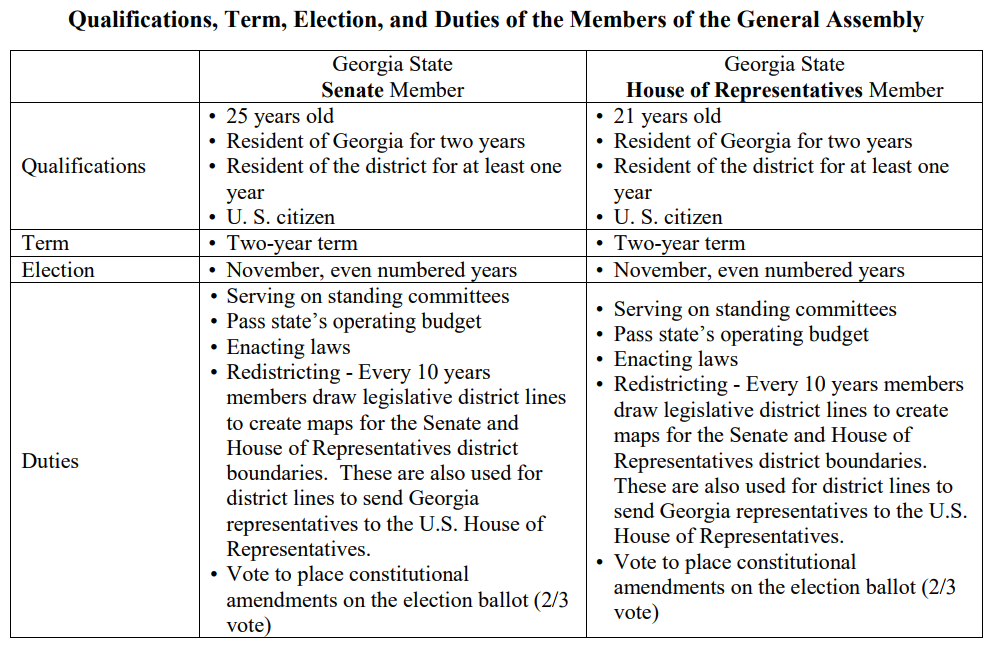

a. Explain the qualifications for members of the General Assembly and its role as the law-making body of Georgia.

b. Describe the purpose of the committee system within the Georgia General Assembly.

c. Explain the process for making a law in Georgia.

d. Describe how state government is funded and how spending decisions are made.

b. Describe the purpose of the committee system within the Georgia General Assembly.

c. Explain the process for making a law in Georgia.

d. Describe how state government is funded and how spending decisions are made.

- What are the qualifications for members of the General Assembly?

- How and why does the committee system function?

- What is the process for making a law?

- How is the state government funded?

- How are spending decisions made by the state?

The Lessons

|

|

Video LessonsYouTube Playlist Lesson & Standard Lesson Reviews

|

|

|

VIDEOS IN THE LESSON

|

CG2.a - Qualifications for General Assembly and its Role

|

|

CG2.b - Purpose of the Committee System

|

CG2.c - Process for making a law in GA

|

CG2.d - How State Government is Funded & How Spending Occurs

The GA Government | GeorgiaStandards.org

GSESS8CG2.a

The primary function of the General Assembly is to make the laws that govern Georgia. This involves the proposal of legislation, committee consideration, and finally action by the full house—a series of steps that have to be repeated in both houses.

The Organization of the General Assembly - the House of Representatives

The Georgia House of Representatives is made up of 180 members. It is presided over by the Speaker of the House. The speaker is elected by all of the members of the House. The Speaker’s powers include scheduling debates, voting, and assigning House members to committees. The Speaker of the House has historically been a member of the party in power, though technically they do not have to be.

There are three other leaders in the General Assembly. This includes the Majority Leader, the Minority Leader, and the Floor leader. As the name implies, the Majority leader is responsible for making sure its members vote for the bills and agenda that majority party favors and the same is true for the minority leader. The Floor leader’s role is to promote the interest of the Governor on the house floor.

The Organization of the General Assembly - the Senate

The Georgia Senate is composed of 56 members. It is presided over by the Lieutenant Governor, who is also known as the “President of the Senate.” The Lieutenant Governor is elected directly by Georgia’s voters. As the chief officer of the Senate, the Lieutenant Governor’s powers include promoting committee chairs. Since the Lieutenant Governor is voted for directly by the people, there is a chance that he or she may be a member of the minority party.

GSESS8CG2.b

Most of the work conducted in both houses of the General Assembly is in the committee system. The House of Representatives is comprised of 36 standing committees while the Senate is made up of 26. Each of these committees has a particular focus such as agriculture or education. Each member of the General Assembly is responsible for serving on at least two or three committees. Each of these committees can, create, amend, change, or kill legislation.

There are four types of committees in the General Assembly. These are:

GSESS8CG2.c

It is a complex and lengthy process for the legislative branch to fulfill its role as the lawmaking body for the state. The 16-step process is outlined below. Bolded information is included to provide a basic understanding of the lawmaking process for students.

A legislator introduces an idea for a law (this could be based on the needs of his or her constituents, suggestions made by the Governor or Floor Leader, or his or her own ideas or beliefs).

GSESS8CG2.d

In order for the state government to function effectively, the government must generate revenue (money) to operate. This is necessary for many government-sponsored programs to meet the needs of the citizens of the state. The General Assembly determines the types of revenue sources and the terms by which they operate. The Department of Revenue, an agency of the state government, is charged with the responsibility of administering and collecting revenue while the governor, the state’s budget director, is also involved in revenue decisions.

Georgia’s government collects tax and non-tax revenues. Tax revenues are generated from the following types of tax sources:

Non-tax revenues are generated from fees, the state lottery, and settlement funds.

The Organization of the General Assembly - the House of Representatives

The Georgia House of Representatives is made up of 180 members. It is presided over by the Speaker of the House. The speaker is elected by all of the members of the House. The Speaker’s powers include scheduling debates, voting, and assigning House members to committees. The Speaker of the House has historically been a member of the party in power, though technically they do not have to be.

There are three other leaders in the General Assembly. This includes the Majority Leader, the Minority Leader, and the Floor leader. As the name implies, the Majority leader is responsible for making sure its members vote for the bills and agenda that majority party favors and the same is true for the minority leader. The Floor leader’s role is to promote the interest of the Governor on the house floor.

The Organization of the General Assembly - the Senate

The Georgia Senate is composed of 56 members. It is presided over by the Lieutenant Governor, who is also known as the “President of the Senate.” The Lieutenant Governor is elected directly by Georgia’s voters. As the chief officer of the Senate, the Lieutenant Governor’s powers include promoting committee chairs. Since the Lieutenant Governor is voted for directly by the people, there is a chance that he or she may be a member of the minority party.

GSESS8CG2.b

Most of the work conducted in both houses of the General Assembly is in the committee system. The House of Representatives is comprised of 36 standing committees while the Senate is made up of 26. Each of these committees has a particular focus such as agriculture or education. Each member of the General Assembly is responsible for serving on at least two or three committees. Each of these committees can, create, amend, change, or kill legislation.

There are four types of committees in the General Assembly. These are:

- Standing Committees: Permanent committees or those that continue for every legislative session

- Ad hoc Committees: Committees created for a special purpose

- Joint Committees: A committee made up of members of the Senate and House

- Conference Committees: Created when the House and Senate create different versions of a bill. The members of each house must compromise and make one bill for it to become a law.

GSESS8CG2.c

It is a complex and lengthy process for the legislative branch to fulfill its role as the lawmaking body for the state. The 16-step process is outlined below. Bolded information is included to provide a basic understanding of the lawmaking process for students.

A legislator introduces an idea for a law (this could be based on the needs of his or her constituents, suggestions made by the Governor or Floor Leader, or his or her own ideas or beliefs).

- A legislator introduces an idea for a law (this could be based on the needs of his or her constituents, suggestions made by the Governor or Floor Leader, or his or her own ideas or beliefs).

- The legislator goes to the Office of Legal Counsel to determine and remedy any legal issues that the bill may face.

- The legislator files the bill with the Clerk of the House or Secretary of Senate.

- The bill is formally introduced (1st Reading).

- The bill is assigned to a standing committee.

- The bill receives a 2nd reading (process differs in House and Senate).

- The bill is considered by committee (bill can be engrossed, killed or amended).

- The bill is reported favorably by the committee and returned to the Clerk or Secretary.

- The bill is placed on a general calendar.

- The Rules Committee meets and prepares a rules calendar.

- The presiding officer calls up bills for calendar.

- The bill receives a 3rd reading (bill is now up for debate and voting).

- If the bill is approved, it is sent to the other house.

- If the bill is passed by second house, it is returned. If bill is not accepted, it is either killed or brought before a conference committee.

- If accepted by both houses, the bill is sent to the Governor for approval.

**The Governor may sign the bill or do nothing (it becomes law). Governor may veto the bill (Assembly can override with veto with 2/3 vote). - Act is printed in the Georgia Laws Series and becomes law the following July 1.

GSESS8CG2.d

In order for the state government to function effectively, the government must generate revenue (money) to operate. This is necessary for many government-sponsored programs to meet the needs of the citizens of the state. The General Assembly determines the types of revenue sources and the terms by which they operate. The Department of Revenue, an agency of the state government, is charged with the responsibility of administering and collecting revenue while the governor, the state’s budget director, is also involved in revenue decisions.

Georgia’s government collects tax and non-tax revenues. Tax revenues are generated from the following types of tax sources:

- Individual income taxes - a graduated tax based on income that individuals or married couples generate in the form of salaries, wages and/or investments. These graduated taxes rise as taxable income increases. This tax generates 40% - 45% of the state’s revenue.

- Corporate income taxes - a flat tax (6 percent since 1969) on income that a corporation generates within state boundaries. This form of tax generates about 3% - 5% of the state’s revenue.

- Insurance premium taxes - placed on insurance companies that sell insurance in Georgia. These companies are not subject to corporate income taxation. This type of tax generates approximately 2% of Georgia’s yearly revenues.

- General sales taxes - a tax placed on customer purchases in retail stores. This tax is a percentage of the price of the item purchased. Georgia’s sales tax rate is 4% but local governments have increased the percentage of sales tax based on optional sales taxes at the local level. This usually brings the sales tax rate to 7% or 8%. When most food items were exempt from sales tax, this form of tax was the leading source of revenue for the state. However, it is now the second highest source of revenue, producing about 30% of the state’s revenues.

- Property taxes - this form of tax generates revenue for local government and adds only a small portion to the state’s revenue funds (less than 1%). Once county and city governments collect taxes, they share a small portion with the state in the form of a state property tax. The Department of Revenue guides local governments to ensure that there is some uniformity from county to county.

- Excise taxes - special taxes placed on items such as gasoline, alcoholic beverages, and tobacco products. These taxes are usually fixed amounts per item as opposed to a percentage of the price of the item. Excise taxes generate about 1% - 2% of the state revenues and are applied to the state’s general fund.

- Estate (Inheritance) taxes - these taxes are payable from the estate of deceased persons and are related to the federal government’s estate tax. Adjustments in federal law have caused the estate taxes to generate less revenue than in the past. Currently, estate taxes provide less than 1% of state revenues.

Non-tax revenues are generated from fees, the state lottery, and settlement funds.

- Fees - generated from entrance fees into state parks, fees for occupational and recreational licenses (also known as regulatory fees - the government regulates the occupation or activity). These fees generate about 3% - 4% of state revenues.

- The state lottery - this third-largest revenue source for the state generates 5% of the state revenues per year. By law, lottery revenue can be spent for special programs including college and technicalschool HOPE scholarships, pre-kindergarten programs and technology for education programs.

- Settlement programs - the following two programs generate more than 2% of state revenues. Since 1998, to off-set costs to the state from cigarette smoking health issues, Georgia and other states participate in the tobacco-settlement-fund program. The state also supports an indigent-care trust fund. In conjunction with federal funds, this trust fund helps hospitals cover the costs of providing health care to the poor.

Extra

Nothing yet. We shall see...